Web3 growth tools attract $600M

Here's why marketing will be web3's next major use case

The Web3 Growth Landscape 2023

The Web3 Growth Landscape: Interactive Map and Database. Add new companies, here.

Insights TLDR

$600M+ has been raised by 71 web3 growth startups;¹ nearly all are preseed or seed stage

Messaging, Quests, & Loyalty are the most well-funded categories ($100M+)

Analytics and Loyalty are the most crowded categories (25+ teams), followed by Community Tooling and Messaging (15+ teams)

Affiliate / Referrals is the breakout category in H1. There are 2x more companies than at the start of 2023, yet only 1/3 of the companies are VC-backed today. But beware, several teams have pivoted in or expanded their offerings to cover this space.

There’s a growing subcategory within Attribution / AdTech emerging — data unions helping users monetize their data by selling it to advertisers

Quests and Ad Networks are increasingly competing for advertising dollars, empowered by the rise of web3 attribution / ad tech

Discovery is relatively underfunded, yet these companies have the potential to be some of the biggest ad real estate proprietaries in web3 if they invest in long-term growth strategies.

¹ 100+ have raised but their raises are not public, so the actual figure is likely higher (of the 71 cited, ~20 teams privately shared their raise details with us to be included in this report)

Intro

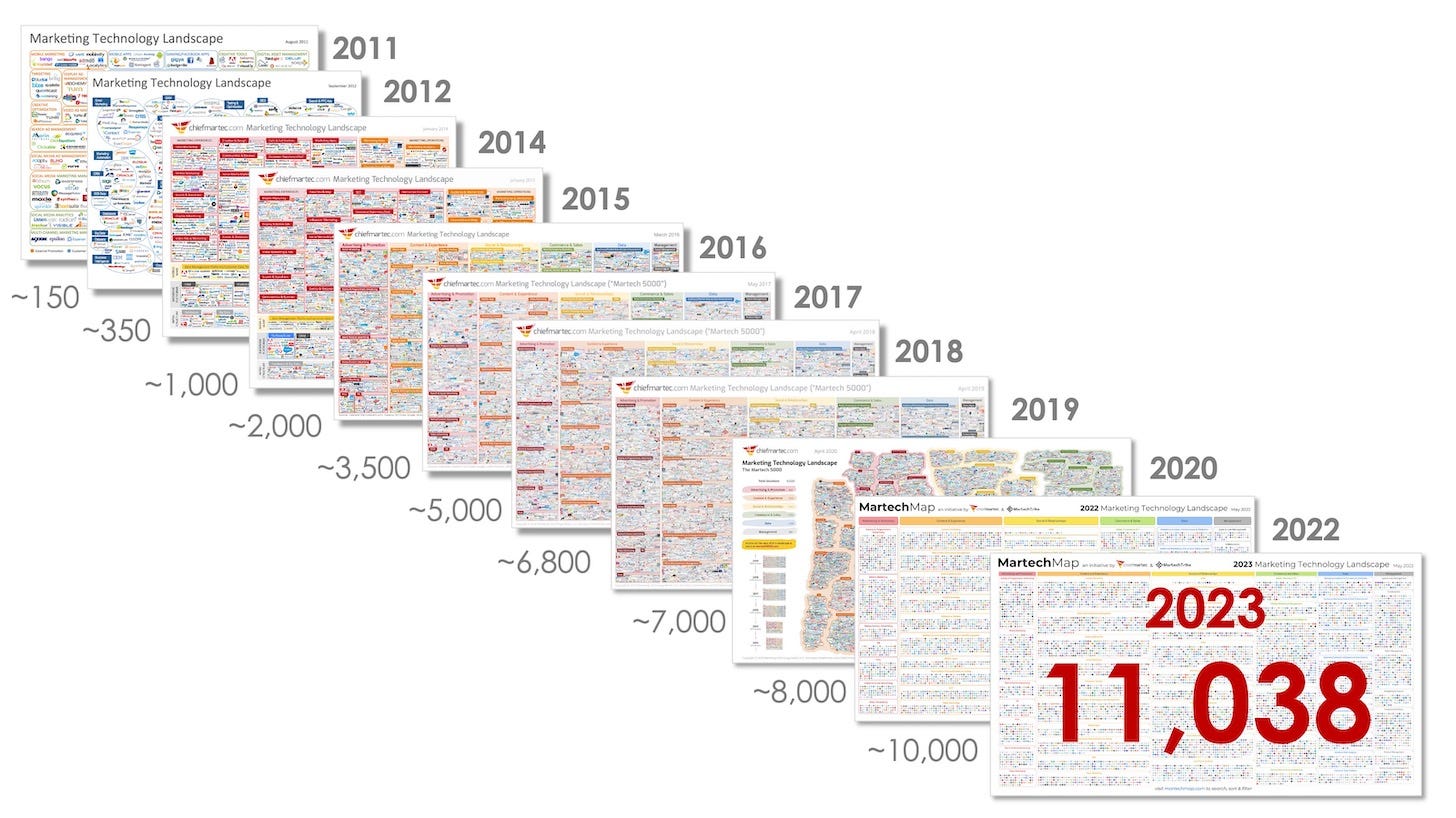

The 2010s were the golden age of digital marketing. Marketers were empowered with a rich tech stack for measuring ROI, monitoring revenue, & modeling LTV. Naturally, the MarTech landscape grew tremendously over the past decade, from 150 companies in 2011 to 11,000 in 2023:

Chief MarTech’s 2023 Marketing Technology Landscape (source)

Yet by the late 2010s the tides began to turn, sparked by GDPR in 2018, CCPA in 2020, and Google announcing the end of 3rd party cookies in 2021. What had been built to near marketing perfection began to crumble with the turn of the decade.

As web3 emerged in the 2020s, so did a more community and privacy centric marketing environment. Buyer behavior shifted too, with consumers engaging on “dark social” channels like Discord, Telegram, and Reddit which are notoriously difficult to track. This meant that marketers could no longer rely on the targeting methods they’ve used in the past.

Today there are nearly 200 companies thinking deeply about our new digital media landscape. 71 of these startups have collectively raised $600M+ in funding.

This report delves into this new industry and the resulting web3 growth stack. It features a comprehensive database of 180 of the most promising web3 growth companies and includes both publicly announced and privately shared fundraising data.

About Safary

Safary is a community-first company building a marketing attribution platform for web3 teams to analyze their marketing CAC, channel ROI, and customer LTV.

We’re proud to have played a small role in developing the web3 growth ecosystem by connecting the top web3 growth leaders and sharing their insights with the wider industry.

Category Insights

The Web3 Growth Landscape: Interactive Map and Database. To add a new company, fill out this form.

This market map includes 180+ teams building web3 growth tools and experiences across adtech, quests, crm, loyalty, analytics, and more. The complete database can be found here.

AdTech / Attribution

Note: Each category is split into: Definition (🤔) → Narrative (🖼️) → Insights (💡).

There are 9 web3 adtech / attribution companies, of which 6 have raised a combined $22M.

AdTech: infrastructure for buying & selling digital advertising real estate

🤔 The advertising industry consists of publishers (selling digital advertising real estate), advertisers (buying ad space from publishers), & networks / exchanges (intermediaries bundling ad real estate from publishers to sell to advertisers).

🖼️ The industry is controlled by monopolistic tech giants (Facebook, Apple, Google) monetizing consumer attention. The space is ripe for innovation via web3, which presents a new privacy paradigm (pseudonymous identities but public behaviors), public data set on-chain enabling scale from day one, and a unified and private log-in via wallets.

💡 There are 2 ad tech companies — Addressable (leveraging web2 & web3 data to help advertisers target & retarget users) and Superfine (helping publishers scale revenue).

Attribution: infrastructure for tracking and analyzing marketing campaigns

🤔 Attribution tracks how consumers interact across the internet (”user journey”). It has historically leveraged a combination of custom links (UTMs, ref codes), browser data (cookies, fingerprinting), & in-app analytics (event analytics) to determine which marketing channel to credit for a conversion.

🖼️ Attribution is dying due to consumer privacy legislation (GDPR, CCPA) and tracking challenges (the end of IDFA / cookies, Apple’s Tracking Transparency). Web3 can create a more powerful, accurate, and privacy friendly attribution system.

💡 There are 4 web3 attribution companies (Safary 🦁, ARCx, Spindl, and Wombi), which raised a combined $11M. It’s still early days: they’ve each been building for ~6 months. Safary’s platform is live and you can sign up here.

💡 The web2 mobile attribution players (Appsflyer, Adjust) have not made a splash in web3 yet, despite Appsflyer having a web3 landing page for over a year.

Identity: user profiles and activity leveraged by advertisers for targeting and personalization

🤔 Consumer data and behavior constitute a core input for advertising. The idea is that if we know a lot about you, we can predict future purchasing behavior.

🖼️ Consumer data has historically been misused through unauthorized access, tracking, and distribution for advertising purposes. By contrast, web3 promises to give consumers greater control over their data and the ability to monetize it.

🖼️ In web2, demographics and other personally identifying information about who you are is used to predict what you will do or buy. In web3, where transactions are public, we know what you do and buy, so maybe we no longer need to know who you are.

💡 There are 3 identity companies focusing on helping web3 users better own and monetize their data (Snickerdoodle Labs, Oamo, and Jomo). They enable users to opt into communication with advertisers in exchange for monetary discounts and rewards. Snickerdoodle raised $2.4M in 2021, Oamo raised $1.3M in 2023, and Jomo is in stealth.

💡 While data unions have historically not reached the scale required to attract advertisers, today’s evolving privacy landscape combined with the web3 ethos and technology may provide fertile ground for these players to flourish.

Ad Networks

Note: Each category is split into: Definition (🤔) → Narrative (🖼️) → Insights (💡).

🤔 Ad networks bundle ad real-estate from publishers to sell to advertisers. They bridge the gap between advertisers and publishers by creating an efficient ad buying process for advertisers, reaching multiple publishers through a single platform.

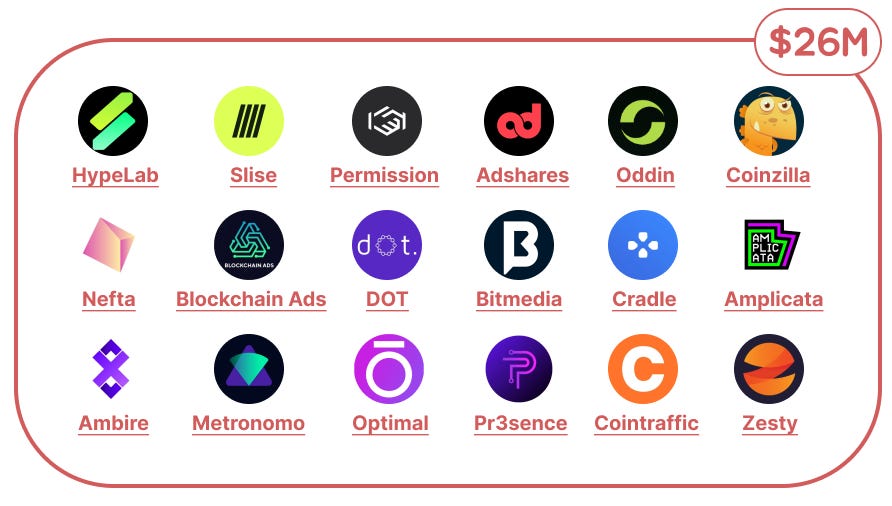

There are 18 ad networks, of which 6 have raised a combined $22M

🖼️ While privacy regulations are great for consumers, these policies further consolidate Big Tech’s power and significantly disadvantage smaller businesses that lack large consumer data sets. By contrast, web3’s public data set offers advertisers equal access to rich consumer data while protecting privacy through a veil of pseudonymity.

💡 Attitudes around advertising are shifting as the web3 market matures. An ad tech boom is coming as teams face new expectations of ROI & CAC-based performance goals.

💡 There are two generations of web3 ad networks. The 1st generation (2015-2021) are web2 ad networks serving crypto publishers and audiences (Coinzilla, Bitmedia). The 2nd generation (2022-) leverages web3 data for targeting web3 natives (HypeLab, Slise).

💡 Distribution networks have historically pioneered new ad formats. Early web3 experiments include the “Modern Billboard project”, which created a network of startups selling site real-estate as NFTs to shepherd an alternative to centralized advertising services.

Quests

Note: Each category is split into: Definition (🤔) → Narrative (🖼️) → Insights (💡).

🤔 Questing platforms are engagement marketplaces. They create networks of web3 users and direct their attention toward incentive offers by companies for completing specific actions.

There are 18 questing companies, of which 12 have raised a combined $100M.

🖼️ While ad networks operate on a CPM or CPC basis, quest platforms effectively function as CPA-based networks, incentivizing mid-to-down funnel actions, and facilitating a more direct relationship between companies and prospective users.

💡 Quests have historically been used to drive short-term vanity metrics like social followers and content engagement, but are now being used to drive deeper funnel metrics via multi-step quests with both off-chain and on-chain components.

💡 Several of the most reputable teams are now using quests for UA including Coinbase, dYdX, Uniswap, Solana, Phantom, & Axelar.

💡 YGG is the largest new entrant to the quest space; time will tell for how they leverage their existing player base to engage and grow games.

Loyalty

Note: Each category is split into: Definition (🤔) → Narrative (🖼️) → Insights (💡).

🤔 Loyalty programs leverage rewards such as discounts, access, and experiences to positively impact customers while driving repeat purchases and long-term retention.

There are 28 web3 loyalty companies, of which 20 have raised a combined $115M:

🖼️ As CAC rises YoY, brands need new ways to increase customer LTV and retention. Loyalty programs offer one solution, yet they’re often stale and highly transactional (spend X, get Y).

🖼️ Web3 loyalty is not a copy paste of web2 loyalty, but is rather meant to unlock acquisition by engaging the community to be part of the marketing arm and enabling more seamless x-brand partnerships. Longer term, these loyal groups form a core part of product dev too.

🖼️ Tokenizing loyalty rewards creates better incentives for brands and consumers. When rewards are interoperable, consumers can trade rewards, maximizing the value they receive. Meanwhile, brands acquire rich 1st party data, drive deep engagement, and increase profits.

💡 Brands initially jumped into web3 with a short-term mindset, quickly facing criticism for treating NFT drops as one-off cash grabs. In response, they now focus on leveraging NFTs as tools to increase long-term engagement and loyalty.

💡 Teams selling into brands have the most success selling to marketing & innovation teams that are goaled on engagement, yet they tend to have small budgets compared to IP licensing teams that are goaled on revenue. Loyalty providers must find a way to serve both, helping brands drive customer engagement while further monetizing their IP.

💡 8 companies left the category in H1 — our guess why? Loyalty is a sink or swim category: teams will live or die by their ability to close enterprise deals. Those left are well-capitalized, and likely better suited to serve the world’s biggest brands.

Growth Analytics

Note: Each category is split into: Definition (🤔) → Narrative (🖼️) → Insights (💡)

🤔 Growth analytics platforms aggregate on-chain, platform, and social data to surface insights on web3 holders and communities.

There are 26 web3 growth analytics companies, of which 9 have raised $40M:²

🖼️ Growth funnel data is siloed both off-chain (Discord, Twitter) and on-chain (wallets, transactions). The user experience is fragmented across platforms, creating new challenges (e.g. new data sources & pseudonymous users) for web3 teams.

🖼️ On-chain data, wallets, and smart contracts are becoming mainstream, yet professionals lack the technical skills to draw insights from this data. Like in web2, they don’t want to rely on engineering teams to study growth data, create reports, and conduct experiments.

💡 Blockchain analytics has become somewhat commoditized, leading several players to verticalize, e.g. Helika and QU3ST that focus on web3 gaming analytics.

💡 The web3 growth analytics space had the most noteworthy pivots in H1 (Merlin, Garden, & Definitive Intelligence); the last of which raised a $20M seed in 2022.

² We identified 7 additional teams that raised, but couldn’t verify the amount as its not public.

Affiliate & Referrals

Note: Each category is split into: Definition (🤔) → Narrative (🖼️) → Insights (💡)

🤔 Affiliate & referral platforms streamline the process of discovering, tracking, and rewarding B2B partners and B2C advocates.

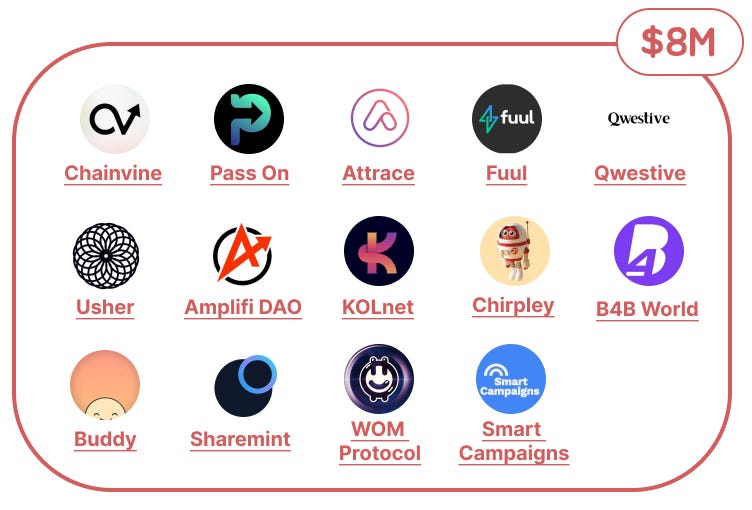

There are 14 affiliate marketing / referral companies, of which 4 have raised $8M:

🖼️ Web2 affiliate & referral models typically pay referrers a fixed fee (”get $25 when your friend activates”), while web3 enables payouts that are more dynamic and lucrative (”get X% of the revenue generating by your friend”).

🖼️ Payments are instant, so there’s no more net X-day terms, meaning affiliates need less working capital and therefore have negligible barriers to scaling profitable channels.

💡 Web3 teams have began taking notice of the tremendous success of affiliate programs from GMX, Lido, and Coinbase. As a result, this is breakout category in H1 with 2x more companies than 6 months ago.

💡 Several teams from adjacent verticals (crm, adtech) have pivoted into the space in recent months, while others have added affiliate / referral features.

Community Tooling

Note: Each category is split into: Definition (🤔) → Narrative (🖼️) → Insights (💡)

🤔 Community platforms provide tools for community management, engagement tracking, and analytics to facilitate improved collaboration, member retention, content creation, and growth.

There are 22 web3 community tooling companies, 11 of which have raised a combined $70M:

🖼️ Community is central to early stage web3 growth. It’s powerful, yet community leaders spend 50%+ of their time on repetitive tasks that could be solved with automation.

💡 Community Tooling is the most diverse category, with tools ranging from web3 security to Discord automation, web3 customer support, and more.

💡 These companies are occasionally in direct competition with web2 incumbents who raised large rounds and added simple web3 features. Such companies include Commsor, Common Room, and Orbit, which have raised a combined $139M.

Messaging

Note: Each category is split into: Definition (🤔) → Narrative (🖼️) → Insights (💡)

🤔 Web3 messaging platforms are protocol-level communication networks that enable cross-chain messaging and notifications for dapps, wallets, services, and on-chain communities.

There are 18 companies, of which 16 have raised $200M:

🖼️ Web2 messaging systems rely on centralized servers, which pose risks related to privacy, data ownership, and censorship; while web3 messaging protocols ensure trustless communication and enable communities and platforms to interact with their holders.

💡 Messaging platforms often differ between full stack e.g. app + protocol, app only, and protocol only.

💡 2x more teams entered the messaging space in H2’22, yet no players pivoted into or out of this category in H1’23. While well-funded, it’s also a category that has had the most difficulty finding its footing.

💡 The funding data is skewed by Status, a mobile eth OS which had a $100M ICO in 2017. But even excluding this raise, messaging would still be the category with the 2nd highest funding after loyalty ($115M).

CRM

Note: Each category is split into: Definition (🤔) → Narrative (🖼️) → Insights (💡)

🤔 Web3 CRMs help teams manage and analyze their customer interactions, both on-chain and off-chain, to create personalized and target campaigns.

There are 10 CRM companies, of which 6 have raised a combined $19M.

🖼️ As the messaging layer forms, CRMs will be unlocked, creating the next generation of marketing automation platforms.

💡 CRMs were the fastest growing category in H2’22 (17 teams), as companies pivoted into the space from community tooling, yet they’ve declined in popularity since then.

💡 There’s now convergence from CRM into the loyalty category, which has less to do with the platform value prop and more to do with who they serve. We’ve seen a growing shift from CRM companies serving web3 natives to trying to sell into web2 brands.

Discovery

Note: Each category is split into: Definition (🤔) → Narrative (🖼️) → Insights (💡)

🤔 Discovery platforms aggregate web3 products and enable users to share verified reviews.

There are 8 discovery companies, of which 5 have raised a combined $13M, more than half of which was raised by DappRadar.

🖼️ Web3 discovery platforms and aggregators are necessary to curate web3 products in an easily accessible manner with reviews verified as real users on-chain.

💡 Discovery platforms have the potential to be some of the biggest ad real estate proprietaries in web3 if the invest in long-term strategies like SEO. Look no further than CoinMarketCap, among the highest trafficked websites on the internet (bootstrapped and acquired for $400M).

Growth Agencies

Note: Each category is split into: Definition (🤔) → Narrative (🖼️) → Insights (💡).

🤔 Web3 growth agencies advise and deploy growth strategies on behalf of blockchain projects.

There are 18 web3 growth agencies, a few of which have 50+ employees:

🖼️ Web3 companies face new foundational challenges, from platform constraints to pseudonymous users, and often lack the in-house expertise to grow their project.

💡 While not a tech tool, the web3 growth agencies deserve their spot on the map. Not only do they cut across the ecosystem, but they’re generating more revenue today than the majority of VC-backed growth tooling companies.

Gratitude

Thank you to the following Safary members and supporters who contributed to this web3 growth database and report:

Vanessa Grellet, Managing Partner at Aglae Ventures [VC]

Jay Drain Jr., Partner at a16z crypto [VC]

Qin En Looi, Partner at Saison Capital [VC]

Quinn Campbell, co-founder of Superfine [Adtech]

Joe Kim, co-founder of HypeLab [Ad Networks]

Oleksii Sidorov, co-founder of Slise [Ad Networks]

Bryan Altman, co-founder of Ziggy [Affiliate / Referrals]

Brandon Kumar, co-founder of Layer3 [Quests]

Brian Flynn, co-founder of Rabbithole [Quests]

Blake Kim, co-founder of Myosin [Agency]

Eric Zhang, co-founder of 2.5 Intelligence [Community Tooling]

Alex Horn, CPO of Notifi Network [Messaging]

Helena Gagern, co-founder of Salsa [Messaging]

Alex Niu, co-founder of W3W [CRM]

Ken Sielecki, co-founder of Smart Campaigns [CRM]

Yuriy Lifshits, co-founder of Superdao [CRM]

Chirag Mahapatra, co-founder of Blaze [CRM]

Eric Forst, co-founder of Blocksee [CRM]

Sambhav Jain, co-founder of Intract [Loyalty]

Tara Fung, co-founder of Co:Create [Loyalty]

excellent info