Web3's Coca-Cola Moment

Tapping into incentive design to catalyze better ad experiences

Written by Oleksii Sidorov (Slise) and Qin En Looi (Saison Capital)

What do Coca-Cola and web3 have in common?

Not much at first glance.

Yet there are timely lessons that web3 can glean from the world’s most popular beverage!

Let’s begin with the origin story of Coca-Cola. The American Civil War was not kind to recipe creator John Stith Pemberton. After sustaining a sabre wound, the soldier became addicted to morphine. Desperate for a cure, this doctor brewed a potent concoction of coca wine, kola nut extract, and damiana. A brown liquid advertised as an “intellectual beverage”, the first version of Coca-Cola was anything but successful, generating just $50 in its first year. Pemberton sold the rights to the Coca-Cola formula and brand in 1888 for $1,750 - just over $50,000 today.

Fast forward 135 years and 94% of the world recognizes the iconic white cursive on a red background as the Coca-Cola brand.

What led to the ‘mass adoption’ of Coca-Cola? There are many factors, but advertising has played a major role in making this medicinal concoction the world’s most popular drink. Between 2014 to 2020, Coca Cola spent $4B annually on advertising. The brown liquid that came out of Georgia laid the foundations for a global conglomerate generating more than $30B in annual revenue.

Can ads do the same for web3? More interestingly, could web3 also improve the ad experience?

Why do ads feel unwanted?

The common reaction to ads, especially amongst web3 natives, is “eeck!”. Just as few early adopters appreciated Pemberton’s beverage, ads in web3 seem equally unwelcome. From a builder perspective, using ads can often be considered a sellout. For users, ads carry memories of misused data, annoying interruptions, and being taken advantage of.

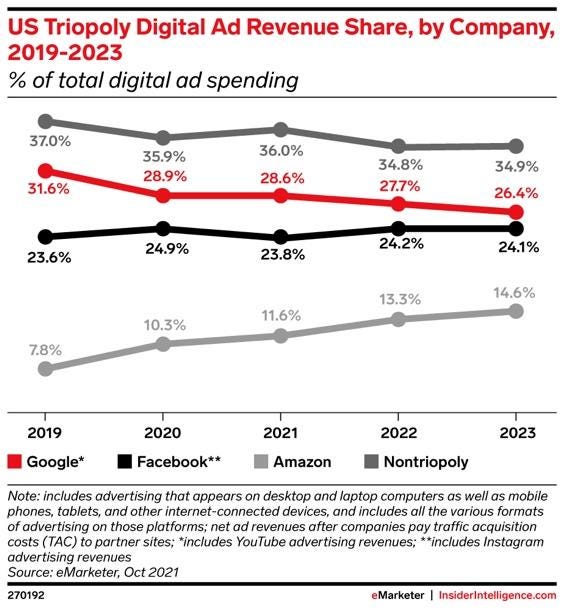

Many of these negative perceptions stem from the power imbalances in contemporary advertising. A whopping 86% of digital ad revenue is concentrated in 3 companies: Google, Meta, and Amazon. This has established unfair advantages in accruing first-party data - the kind users generate through online actions - and creates impenetrable ‘walled gardens’ with little space for competitors to offer a better ads experience for audiences. It is little wonder that the ads experience is as unpleasant as interacting with the mob for advertisers and consumers; it’s pitched as a necessary evil with no room for improvement.

In web2, aggregating data created an impenetrable moat: the big get bigger while the disruptor is unable to cross the divide (Image source)

What does web3 bring to ads?

As written previously, web3 heralds a paradigm shift in advertising. The first-party data that Google and Meta used to create unfair moats is now public and accessible, if recorded on a blockchain. With social protocols such as Lens emerging, every user interaction - be it a like or comment - is now on-chain and visible to anyone with a block explorer. Advertisers are no longer walled-in by closed ecosystems, nor is their customer targeting reliant on centralized giants. For example, a fitness application can utilize web3-native ad networks like Slise to discover and target the holders of “move-to-earn” tokens. The possibilities to innovate and improve the consumer ads experience are no longer far-fetched.

If data is no longer the moat, and control is seized from the hands of “too big to fail” tripoly actors, what are the differentiators in advertising?

One factor would be ad network quality and algorithms to more efficiently process data and better understand user intent. Another would be the thoughtfully designed incentives to reward users; the focus of this piece. While incentives were once one-dimensional, web3 has created new, fascinating avenues for incentive design.

The case for rewarding users

While the open nature of on-chain data is exciting, it’s only half the equation. On-chain data needs to be complemented with off-chain data to deliver personalized, relevant ads to users. While interactions with smart contracts and dapps create an accessible on-chain history, most transactions and actions still occur off-chain, where accessibility is limited.

Advertisers and ad networks have two choices: permissioned access to off-chain data, where users approve the sharing of their first-party data, or permissionless access, where user approval is not needed and an understanding of the user is built on a combination of guesswork and algorithms. Both approaches carry distinctive benefits and trade-offs; we believe the permissioned approach will prevail for two key reasons:

#1 - Completeness of data - With data and privacy regulations tightening worldwide, a growing amount of personal data will only be accessible to advertisers and ad networks through the explicit permission of the user. This privileged data tends to be most pertinent in ad targeting, so a permissionless approach will face increasing challenges to achieve data completeness.

#2 - Lack of interoperability across on-chain and off-chain sources - While there are emerging ‘bridges’ like oracles to connect on-chain and off-chain data, or to consolidate on-chain data across multiple chains, interoperability remains tricky. As more blockchains emerge, aggregating and analyzing data across permissionless chains becomes more technically complex than permissioned methods.

If we believe permissioned access to off-chain data is key, then we need incentives to reward users for giving their permission.

Where are the opportunities for incentive design?

One of the most immediate opportunities to incentivize users is the “pay-per-consumption” approach: view an ad, get compensated. The benefit to users is clear: they are directly rewarded for completing the desired action instead of rewarding centralized entities like Google or Meta.

This model can be over-simplistic: few users would consume ads to earn. Ads are often a by-product of a user’s job-to-be-done, whether it’s checking a token price on a coin tracking site, or searching a transaction on a blockchain explorer. Incentivizing a user to divert attention away from their task to view an ad can be costly and the few dollars from an impression or click might not be sufficient.

What if incentives are designed to enable users to complete their jobs-to-be-done faster, cheaper, simpler?

While users might not intentionally divert attention to consume an ad, there are proven models around cashback which supports the user’s intended job-to-be-done, instead of hindering it. Cashback and other forms of affiliate marketing are turbocharged as a result of on-chain data, as the correlation between a user’s identity and their transactions are accessible instantaneously, and can be rewarded with tools like Chainvine and Fuul.

Another opportunity area for incentives is gas fees: the pesky but necessary costs to transact on blockchains like Ethereum. Currently, end users pay the gas fee. While a few dollars per transaction might seem trivial to sophisticated crypto traders, gas fees disincentivize new-to-crypto users, adding extra costs and friction toward adoption. A beginner hoping to transfer their first token may not have the native token to pay for gas. The need to on-ramp a small amount to pay for gas is simply unappealing. Yet, the recent advancement of ERC-4337 reveals an opportunity for advertisers and ad networks to silently cover transaction fees for users, thus creating a seamless experience for all.

Incentives also need not be financial - often, users may be seeking quid pro quo exchanges. Emerging incentive mechanisms such as the DataDAO model enables users to pool data together, creating meaningful and valuable datasets whose value is greater than the sum of parts. The incentive for users is clear - contribute data in exchange for “credits” used to access other forms of data that are otherwise hard to access or aggregate. For example, a user can offer their browsing history data in exchange for tokens, and subsequently, they’ll be able to utilize said tokens to request data around the web3 data economy. In short, non-financial reciprocity may prove to be a viable alternative alongside financial incentives.

The Coca-Cola moment for web3

Incentives expand the possibilities of rewarding users and removing friction. Unhindered by barriers like gas fees and empowered by new use cases through quid pro quo exchanges, we can expect to see more users onboard to web3, generating more demand for web3 applications, which creates a positive flywheel effect for web3 advertising and general adoption.

Just as traditional ads brought Coca-Cola from a non-descript beverage to a cultural icon, web3 ads have the potential to catalyze an inflection point across multiple categories. We expect to see a reshaping of the tripoly advertising landscape where centralized entities have their power undermined, users will be incentivized to share data so they can better accomplish their tasks, and ultimately, mass web3 adoption will accelerate.