The State of Web3 Growth 2024

A Deep Dive into the $1B Ecosystem Shaping the Future of Digital Media

The Web3 Growth Landscape: Interactive Map and Database. Add new companies, here.

Insights TLDR

$1B+ has been raised by 101 web3 growth & social startups¹

$277M in new funding across 23 startups since this time last year

There aren’t many new first rounds; VCs are doubling down on winning bets

Attribution / Analytics, Loyalty, & Social startups received the most new funding, making up 80% of dollars raised across the 10 categories

Messaging is the second most well-funded category with $245M after social & publishers ($400M), yet this category only received $7M in new funding

Ad networks & Community Tools are the most crowded category with 19 teams, followed by Messaging & Loyalty with 18 teams each

Loyalty saw the biggest contraction from 40+ teams building in 2023 to 18 survivors today

Affiliate & Referrals, which was the breakout category in 2023, reduced from 17 teams to 9, with the 2 most well-funded teams closing up shop

¹ Note: Not all of these fundraises are public — 10+ teams privately shared their raise details with us to be included in this report

Intro

You can be right about where the world is headed in 10 years, but if you’re a few years too early, you may not make it. This is a story about those first two years.

The web3 growth stack feels inevitable—web3 companies need to understand their users, deeply engage them, and reach new ones. Today, over 160 companies are building the future of this emerging digital media industry, with 101 startups collectively raising nearly $1 billion in funding.

This report delves into this rapidly emerging industry, offering a comprehensive overview of the most promising web3 growth companies. It includes both publicly announced and privately shared fundraising data, providing a detailed snapshot of the industry today.

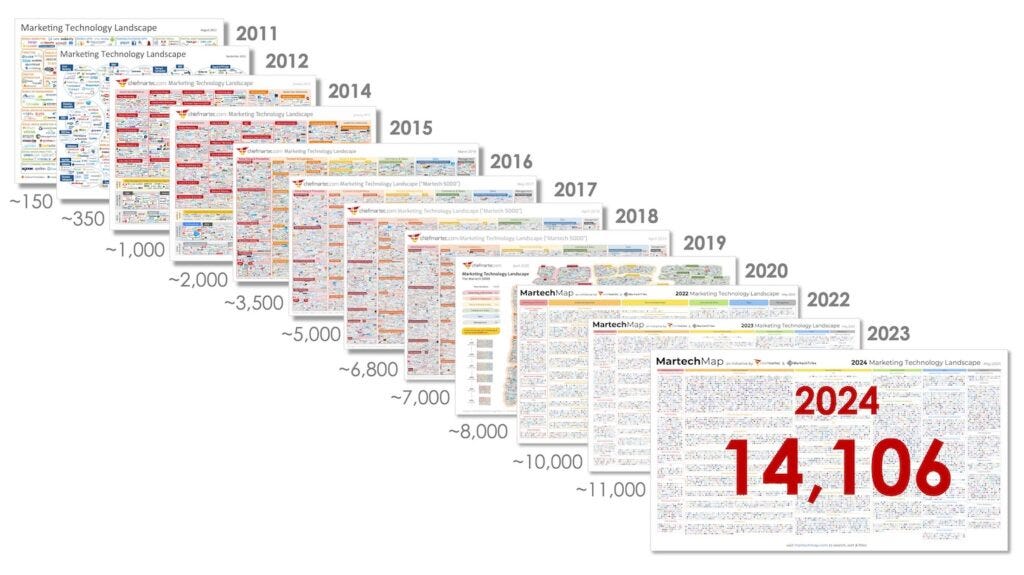

In many ways, the web3 growth industry parallels the rise and fall of digital marketing in the 2010s. The MarTech landscape expanded dramatically, from 150 companies in 2011 to over 14,000 in 2024.

But as the 2020s began, privacy regulations like GDPR and CCPA disrupted this carefully constructed ecosystem. It was in this era that web3 emerged with a more community and privacy-centric marketing environment. Consumers began engaging on “dark social” channels like Discord, Telegram, and Reddit which are notoriously difficult to track. All of the sudden, marketers could no longer rely on traditional targeting methods, prompting the rise of new companies aimed at recreating our digital media landscape.

The first two years of this new digital media industry were challenging. The majority of companies struggled, and more than half didn’t survive. We’ll examine why certain categories failed to gain traction and what we expect in the 2024-2025 cycle.

This report builds on the lessons from last year’s analysis, highlighting the ongoing evolution of the web3 growth stack and the innovative companies driving it forward.

About Safary

Safary is the home for web3 growth leaders. Our platform enables the very best teams to unlock deep user insights and build more direct relationships with their users; and our community provides the knowledge and network essential for their success.

We're proud to have helped evangelize the web3 growth ecosystem by connecting the best growth leaders in crypto and sharing their insights with the wider industry.

Category Insights

This market map includes 160+ teams building web3 growth & social platforms from quests to analytics, attribution, crm, loyalty, publishers, & more. The full database can be found here.

Ad Networks

Note: Each category is split into: Definition(🤔) → Challenges(📉) → Opportunities(💡)

🤔 Ad networks connect publishers and advertisers, streamlining the ad buying process. They aggregate ad space from multiple publishers, offering advertisers a single platform for ad placements.

There are 19 ad networks, 9 of them raising a combined $51M:

📉 While web3 ad networks hold significant potential, they face steep challenges in navigating competition and gaining traction with premium publishers:

1. Competition for Publishers and Advertisers

Although we’re still in the early innings, competition will fierce. New players like Relayer and Spindl are entering the scene facing off against category leaders like Coinzilla and Hypelab.

New networks must solve the classic marketplace dilemma—creating demand (offering low-cost conversions for advertisers) and acquiring supply (paying publishers more for their ad inventory).

To compete, they might offer guarantees to publishers and attract advertisers with cost-per-action (CPA) models where they only pay when users complete their desired conversion event.

Advertisers love the CPA model for its guaranteed results, but publishers hate it as they prefer to be paid for the traffic they generate rather than on the users that make it through the funnel. This forces new ad networks to absorb all the risk, and the longer it takes to build their marketplace, the faster they'll deplete their capital.

And while this is a tough spot for new ad networks, increased competition is GREAT news for the publishers and advertisers who are early to taking advantage of this channel!

2. Unlocking Premium Publishers

In web2, publishers relied on advertising as their main revenue stream, so the value exchange was simple—revenue for eyeballs. However, web3’s leading publishers (e.g., Wallets, Opensea, Uniswap) have alternative revenue models and often view ads unfavorably. Category winners will need to offer them a compelling value proposition to shift this mindset.

💡 These challenges present a unique opportunity — making the CPA model work for publishers, uniquely possible in web3, even if only theoretical today.

Imagine your favorite crypto media site like Blockworks or Messari that share news and research on trading data. If they required wallet sign-in, they could embed a Frame-like widget to buy the token you’re reading about without leaving the article.

This setup could incentivize publishers to share in the risk, as conversions happen on their site. It also benefits advertisers, especially in DeFi, who may not need users to visit their own websites to generate revenue.

In this arrangement, the publisher offers their ad space, the ad network powers the embedded ad unit, the DEX serves the trade, and all three take a cut of the revenue on the volume generated.

This approach could extend beyond media sites to any wallet-aware channels like Discord, Telegram, or other dapps with significant user bases!

Publishers & Social

Note: Each category is split into: Definition(🤔) → Challenges(📉) → Opportunities(💡)

🤔 Publishers & Social platforms aggregate web3 creators or niche-specific info.

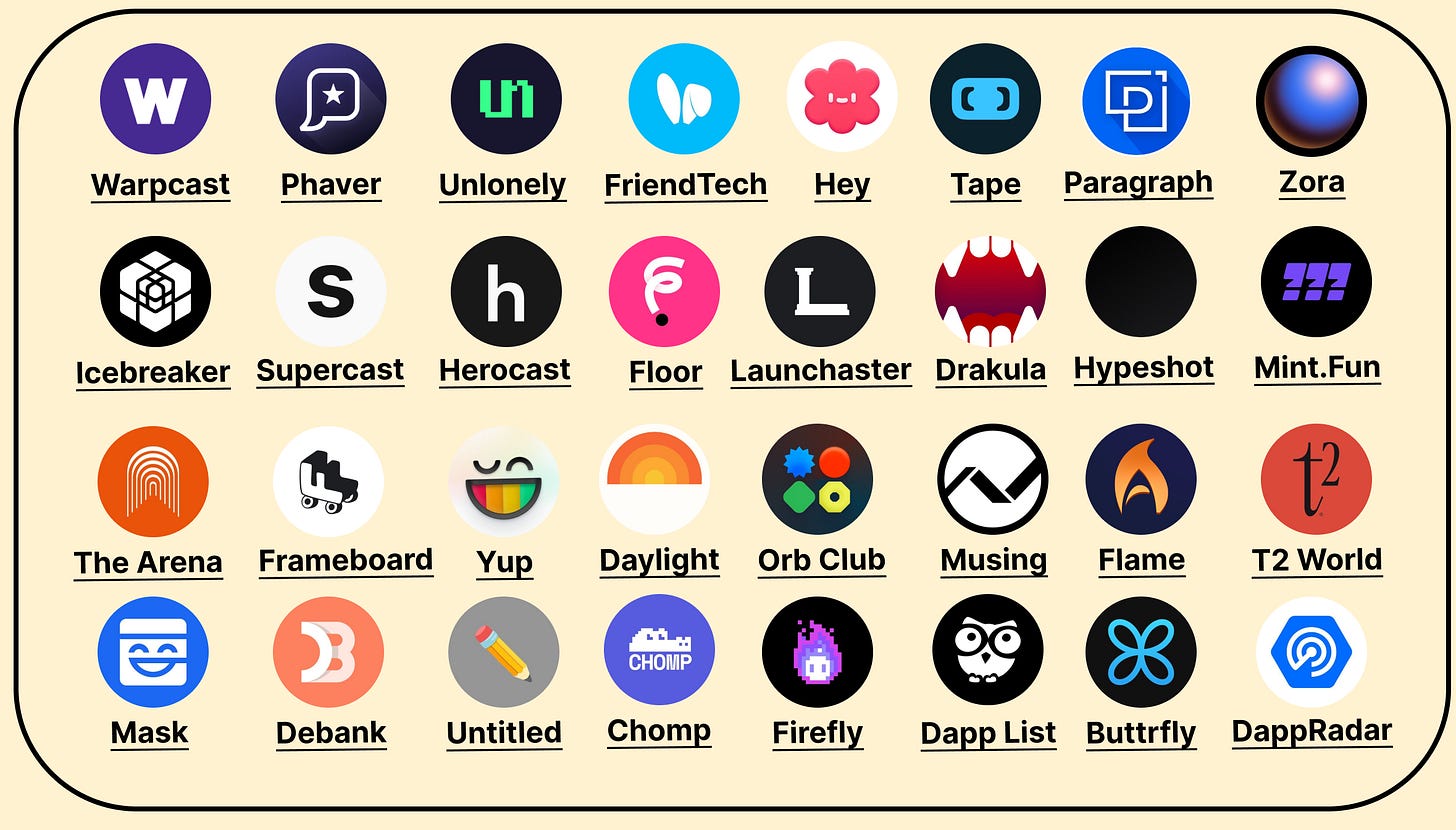

This category includes 32 platforms: 20 social platforms (11 raised $375M) and 12 publishers (8 raised $25M), totaling $400M in funding, $180M of which is new funding:

📉 Web3 social has a retention problem

New social apps face the challenge of convincing users they have staying power, making it worth the effort to build their presence. While tokens have helped bootstrap networks by attracting crypto natives, long-term retention hinges on these platforms offering value beyond mere speculation.

💡 These platforms have the potential to become the biggest crypto publishers (see ad networks section on aligning incentives)

If they can create new, differentiated ways for people to connect online, they could become the primary hubs for onchain communities. This would signal a shift away from platforms like Twitter, with onchain natives interacting through games, streaming platforms, and social apps. Wherever users gather, there’s an opportunity for growth—not just for crypto-native applications but for expanding the ecosystem as a whole.

Attribution & Analytics

Note: Each category is split into: Definition(🤔) → Challenges(📉) → Opportunities(💡)

🤔 Attribution & Analytics aggregate on-chain, in-app, and social data to provide detailed insights into user profiles and consumer behavior across the internet.

There are 14 attribution & analytics companies, collectively funded with $70M, including $25M in fresh funding:

📉 While onchain analytics and attribution platforms hold promise, they faced challenges in fully realizing their potential:

1. Onchain analytics alone is interesting, but not actionable for growth leaders

The need for generalized web3 growth analytics was largely invalidated in Wave 1 (2022-2023), as evidenced by numerous pivots. Helika transitioned to attribution and focused on gaming, Persona became an ad network, Convrt pivoted to B2B CRM, Raleon exited web3 for AI, and others struggled to gain market share.

2. Multi-channel acquisition & performance marketing remain underdeveloped

For attribution to be effective in crypto marketing, companies need to execute multi-channel strategies (e.g., Twitter, blogs, ads, referrals, and quests simultaneously). However, most companies don't operate this way. Instead, they jump from one channel to another—one month running a quest, the next a referral program, then an ad campaign—rarely overlapping these efforts. This makes apples-to-apples comparisons difficult, limiting the effectiveness of attribution.

💡 The web3 growth capabilities we’ve long envisioned is finally here

Teams can now build rich user profiles by combining first-party data with on-chain identities, social graphs, and wallet analytics. The best teams are establishing direct relationships with their users. Gone are the days of tracking nothing, and hoping users just keep coming back. Creating a unified customer data layer with a full 360° view of onchain users is becoming the norm. That’s our focus at Safary Analytics 😉

Affiliate & Referrals

Note: Each category is split into: Definition(🤔) → Challenges(📉) → Opportunities(💡)

🤔 Affiliate and referral platforms simplify the discovery, tracking, and rewarding of B2B partners and B2C advocates. While new web3 products often use waitlists to drive referrals, “referrals” typically refer to engaged users who actively refer their friends.

There are 9 affiliate and referral companies, with 5 having raised a combined estimated $7M—about half of what was raised a year ago:

📉 What was once the fastest-growing category in 2023 has now seen significant consolidation. Two of the most well-funded players, Chainvine and Qwestive, ceased operations and returned funds in 2023. We believe web3 referral platforms have struggled due to several key challenges:

1. Referrals require an established and growing user base to be effective

Referrals can bring in a product’s highest quality users, but they depend on having an initial base of users to drive further growth.

For instance, with an existing user base of 500 real users (a common scenario for many dapps):

Typically, 2% to 30% of users might refer a friend. With a 15% referral rate, 75 of those 500 users might make a referral

If each referrer brings in 3 friends, and 30% convert, this results in 68 new users from referrals.

2. Web3 referrals are not a “set it & forget it” channel

While gaining 68 new users (+13%) from an initial referral program can be impactful, challenges arise in maintaining momentum.

If you’re acquiring 100 new users per month, referrals might only add 13 users, making it difficult to justify even modest platform expenses. To keep the program appealing, you need to continuously innovate, which from a platform perspective means frequently adapting clients’ programs—limiting scalability.

3. The rewards often aren’t lucrative enough to be meaningful for web3 users

The promise of web3 referrals was that referrers could earn more by sharing revenue with the protocol. For example, a referrer might earn 25% of a referee’s transaction fees or a fee based on trading volume.

In practice, most referral rewards have been disappointingly low, often less than web2 counterparts. For example, Hashflow (DEX) launched a referral program offering 1 ARB ($0.80) for every $1,000 traded by the referee. If a friend trades $10K on Hashflow, you’d earn just $8. It’s no wonder evangelists still reference GMX’s successful referral program from April 2022.

This isn’t to say web3 referral platforms can’t succeed, but it’s challenging at crypto’s current scale. Dapps need to acquire thousands of new users monthly to generate the volume necessary to justify investing in referrals as a growth channel.

💡 As with any incentive program, success depends on targeting the right user segment and offering rewards meaningful enough to drive action. Instead of using referral programs as a broad-based user acquisition strategy with small rewards, they could focus on a protocol’s highest quality users with more substantial incentives. These users are more likely to bring in similarly valuable users, improving the overall quality and impact of the program.

Quests

Note: Each category is split into: Definition(🤔) → Challenges(📉) → Opportunities(💡)

🤔 Questing platforms act as engagement marketplaces, connecting networks of web3 users with incentive offers from companies for completing specific actions.

There are currently 12 quest platforms (down from 18 in 2023), with 9 of them raising a combined $103M, including $15M in new funding driven by Layer3’s Series A:

📉 Quests were once effective at boosting metrics through airdrop farming and social follows, but as the market matures, these tactics are losing favor.

These strategies were great for driving short-term engagement and quickly attracting users. However, the industry is now focusing more on genuine user engagement and building lasting communities. This shift reflects a growing emphasis on long-term value and authentic participation, leading quest platforms to rebrand and evolve.

Historically, quest platforms were deeply intertwined with the points meta, where users would complete tasks primarily to accumulate points, often with the end goal of qualifying for airdrops. As airdrop farming fades in effectiveness, the reliance on points alone no longer sustains user interest or platform growth. The challenge now is to transcend this superficial engagement and offer something of real value—something that keeps users coming back because they genuinely find it rewarding, not just because of the promise of points or potential airdrops.

💡 Questing platforms will evolve into incentive experimentation platforms

What’s old is new again—quests are transitioning from simple "click-and-claim" tasks to ongoing, dynamic engagements that bridge traditional loyalty programs with onchain actions. The winning platforms will be those that continuously innovate on “Do X, Get Y” incentive mechanics. They’ll need to design new formats, build the necessary functionality to support them, roll it out to teams, and immediately start working on the next one. In essence, they’ll become experimentation platforms—web3 is too dynamic for anything less.

Loyalty

Note: Each category is split into: Definition(🤔) → Challenges(📉) → Opportunities(💡)

🤔 Loyalty programs use rewards like discounts, access, and experiences to enhance customer satisfaction while driving repeat purchases and long-term retention.

There are 18 loyalty platforms (down from over 40+ in 2023). Of these, 12 have raised a combined $88M, with $30M in new funding, largely due to Blackbird’s $24M Series A:

📉 Web2 brands largely abandoned crypto in 2023, taking growth with them

It’s not surprising that many loyalty platforms either shut down or pivoted out of crypto, as this category was heavily focused on web2. These companies found it easier to shift their offerings without changing their target customers. Interestingly, most of these pivots occurred in the last 6 to 9 months, rather than early in the bear market.

Notable departures include Co:Create ($25M raised) and Hang ($16M). These pivots make sense—rather than chasing web2 brands to create innovative experiences, many companies opted to use their own technology to build consumer experiences, with the potential to pivot back to B2B infrastructure in the future.

💡 With increasing data privacy regulations and the rise of omni-channel consumer experiences (online, offline, and onchain), there’s a growing need for a unified data layer, uniquely enabled by blockchain technology

It’s becoming clear that everything will be a transaction, though not necessarily a monetary one. As more data is generated onchain, brands will gain secure access to increasingly rich user profiles. These profiles will combine onchain social actions and transactions with first-party online and offline data, creating the ultimate data goldmine for major brands. This data will enable brands to create highly targeted audiences, driving repeat purchases and long-term loyalty.

Community Tools

Note: Each category is split into: Definition(🤔) → Challenges(📉) → Opportunities(💡)

🤔 Community platforms offer tools for managing communities, tracking engagement, and providing analytics to enhance collaboration, member retention, content creation, and growth.

There are 19 community tooling companies, with 10 of them raising a combined $87M:

📉 Challenges in communities lacking business models and difficulties in tracking revenue impact

Community tooling companies have faced significant obstacles due to two main issues. First, many communities lack sustainable business models, making it hard to justify investment in specialized tools. Second, it’s challenging to measure how communities directly contribute to revenue. While communities can boost brand loyalty and advocacy, translating these benefits into clear financial outcomes remains complex. These challenges make it difficult for community tooling companies to prove their value and grow in the market.

💡 Redefining community: from long-term, full-funnel engagement to deep, short-term group experiences

Web3 community tooling companies have an opportunity to redefine what a community can be. Instead of focusing on traditional, large-scale communities, they can use blockchain technology to create dynamic, onchain group chats and short-term experiences with integrated financial transactions. This approach allows for meaningful, measurable outcomes without needing a full funnel. By prioritizing value-driven, interactive, and financially intertwined communities, web3 tooling companies can explore new models of engagement and growth, paving the way for transformative changes in the digital landscape.

Messaging

Note: Each category is split into: Definition(🤔) → Challenges(📉) → Opportunities(💡)

🤔 Web3 messaging platforms are protocol-level communication networks that enable cross-chain messaging and notifications for dapps, wallets, services, and on-chain communities.

There are 15 messaging platforms (down from 24 in 2023), with 11 raising a combined $240M, but only $7.5M in fresh funding from Sending Labs’ extension in February:

📉 Messaging wallets is ineffective unless the message reaches a place users frequent

Web3 messaging platforms have struggled because sending messages to wallets is pointless if users don’t see them. Unlike traditional messaging apps that centralize communication in a user-friendly interface, many web3 messaging protocols lack a reliable destination where users consistently check messages. This gap means that even when messages are sent, they often go unnoticed, undermining the communication effort. To succeed, web3 messaging platforms need to create or integrate with ecosystems where users actively engage, ensuring messages are seen and acted upon.

💡 Web3 social apps could become the messaging layer for wallets

It’s possible that none of the existing messaging platforms will succeed. Instead, web3 social apps with integrated messaging layers, like Farcaster, Lens, and DeBank, could take the lead. These platforms allow messaging to wallets in places where onchain users actually spend their time, making communication more effective and relevant.

CRM & GTM

Note: Each category is split into: Definition(🤔) → Challenges(📉) → Opportunities(💡)

🤔 Web3 CRMs help teams manage and analyze customer interactions, primarily using onchain data to create personalized and targeted campaigns.

There are currently 6 CRMs (down from 20 in 2023), with a combined funding of $24M:

📉 Onchain data alone didn’t provide enough value for B2C CRMs to thrive

All the web3 CRMs initially targeted B2C companies (except 3RM), aiming to help them understand their onchain holders and community members. However, it became evident that the greater demand for this targeting data lies within the B2B sector.

💡 The crypto ecosystem is predominantly populated by B2B companies, presenting a larger and underserved market for web3 CRMs

There’s a strong need for B2B companies to leverage onchain data to qualify target companies, while also utilizing non-traditional channels from a web2 perspective (e.g. Twitter and Telegram) to reach them. This shift offers a significant opportunity for web3 CRMs to cater to a market that has been historically overlooked.

Marketing Agencies

Note: Each category is split into: Definition(🤔) → Challenges(📉) → Opportunities(💡)

🤔 Web3 growth agencies provide strategic advice and deploy growth tactics for blockchain projects

There are 15 marketing agencies (down from 32 in 2023), all are bootstrapped:

📉 Selling marketing services to technical teams that don’t believe in marketing is challenging

The agency landscape has become increasingly dynamic, with many new players emerging. A wave of smaller agencies has entered the market, and many experienced growth leaders have transitioned to consultancy roles following layoffs. However, many of these consultants struggled to sustain their businesses beyond six months. If in-house marketers are finding it tough to secure their positions, it’s even harder for solo consultants to make a compelling case externally.

Despite this, there is a noticeable demand for growth support among earlier-stage teams that need non-technical expertise to gain an edge in a saturated market. While the bloated budgets of established projects from the last cycle have decreased, emerging teams are seeking support to differentiate themselves.

The market now favors large agencies capable of offering comprehensive services—including design, growth, and development—over individual operators. This integrated approach is more appealing to clients looking for robust marketing solutions.

💡 Continued consolidation as larger agencies dominate the war on marketing talent

Looking ahead, the marketing agency landscape is likely to see further consolidation, with larger agencies dominating the competition for top talent. These well-resourced agencies are better positioned to offer multi-disciplinary services that smaller, specialized agencies and solo consultants often struggle to match. However, the best operators with distinct expertise in niche areas like tokenomics, brand strategy, and founder storytelling will likely succeed by differentiating themselves and weathering the market’s challenges.

What’s next?

So, what can we expect in the next 2-year cycle?

Firstly, we anticipate significant innovation in incentive programs, including referrals, quests, and loyalty systems. Companies will experiment with new formats and mechanics, aiming to create more engaging and rewarding user experiences.

Secondly, the integration of social elements into messaging platforms will become essential. Web3 social apps are likely to evolve into the primary messaging layers, pushing traditional web3 messaging platforms to incorporate social features to remain relevant.

Lastly, we expect a wave of bold, unconventional ideas that will push the boundaries of what's possible in web3. While some concepts may seem far-fetched today, they could define the next phase of this rapidly evolving industry.

The web3 growth landscape is on the brink of transformation, driven by innovation and a willingness to explore uncharted territory. Those who can adapt and lead in these areas will shape the future of digital engagement and media.

Gratitude

Thank you to all those who reviewed and contributed data to this web3 growth report:

Blue, CMO of Trader Joe

Qin En Looi, Partner at Saison Capital

Simon Chamorro, Head of Growth at Alliance DAO

Jake Stott, Co-founder of Hype

Emily Lai, VP of Marketing at Hype

Isaac Lazoff, Head of BD at Snickerdoodle

Filip Wielanier, Co-founder of Cookie3

Thomas Salas, Co-founder of Relayer

David Phelps, Co-founder of JokeRace

Quinn Campbell, Co-founder of PTAL

Yannick Folla, Co-founder of Oamo

Chirag Mahapatra, Co-founder of Blaze

Alex Cooper, BD at Footprint Analytics

Geoff Renaud, Co-founder of Invisible North & Renaud Partners

Brian Flynn, Co-founder of Boost Protocol

Marc Baumann, Co-founder of FiftyOne Ventures

Roy Levin, Co-founder of Convrt

Yaniv Azar, Co-founder of nReach

Chinmay Patel, Co-founder of PERCS

Ashoat Tevosyan, Co-founder of Comm

One of the best lasting projects

Thank you for the insights!

As 2025 progresses towards its midpoint, what changes or developments (if any) are you seeing from this post?