Welcome to Episode 1 of Safary’s Revenue Series! 🦁

We’re interviewing the growth operators behind the companies that are actually making money in crypto. We’ll break down their growth strategies, challenges, and tech stacks to give you the insights you need to grow your business in crypto & beyond.

In this episode, Justin sits down with 0xInfra, Core Contributor at Raydium, the Solana-native AMM that has weathered market crashes, turned an infra headache into $40M in revenue, and emerged as the go-to liquidity layer for Solana.

0xInfra’s Role at Raydium

0xInfra leads Reactor Labs, guiding core protocol development, app and program upgrades, BD, and investor relations. A key focus today is sustainable revenue generation on Solana and communicating that trajectory to the market.

What Raydium Does & Who It Serves

Origins: Raydium launched as Solana’s first permissionless market maker and the first hybrid AMM. Early on, it routed idle AMM liquidity to Serum’s onchain order book, unlocking deeper books and better execution.

Today: Raydium is the go-to venue on Solana to list and trade new assets with multiple pool types and a renewed emphasis on swaps, perpetuals, and real-world assets.

Customers: The early user was a DeFi farmer seeking yields. The customer base now includes teams that need liquidity for consumer ideas and token launches. Launchpads such as Pump.fun migrated liquidity to Raydium, and Raydium supports many teams going to TGE.

How Raydium Makes Money

Core model: Protocol revenue from maker rebates on swap fees

On most AMMs, 100% of swap fees go to LPs

On Raydium, a portion is captured as protocol revenue, creating ongoing cash flow and supporting deflationary tokenomics through programmatic $RAY buybacks long before it was a trend

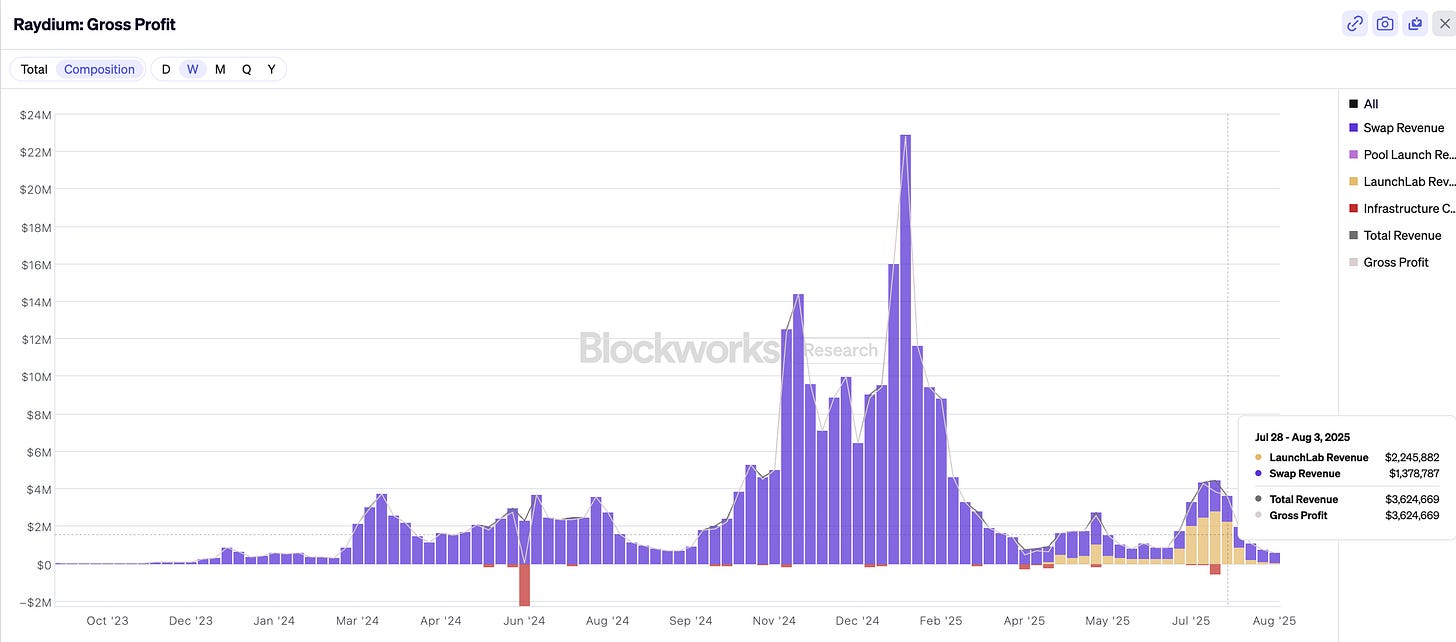

The non-obvious unlock: Pool creation fees introduced in late 2023

Memecoin mania spiked daily pool creations from roughly 100 to more than 15,000, creating overwhelming infrastructure costs

They introduced a small upfront pool creation fee to filter spam and throttle load

To date, that’s generated 300K SOL, or roughly $40M USD, in revenue

The fee began as an operational safeguard and became a top-line driver. Raydium continues to experiment with waivers and reductions for priority partners and bonding curve launches

Raydium’s Growth Flywheel

Raydium operates a three-sided marketplace:

Asset issuers & pool creators → new tokens, memecoins, RWAs

Liquidity providers

Traders

By capturing asset issuance first, Raydium attracts liquidity, which then brings in traders. Memecoins like Dogwifhat and Popcat started this flywheel, by kicking off the asset issuance explosion in late 2023, ultimately driving trillions in lifetime volume through Raydium pools.

From $0 to First Million & Beyond

2021: Find product market fit with the hybrid AMM and help projects list and distribute tokens. Raydium even built an accelerator to support TGEs, fundraising, and seeding liquidity.

Late 2022 to 2023: Post-FTX drawdown crushed Solana volumes and hurt Raydium’s treasury. Raydium reduced operating expenses by about 80 percent, doubled down on Solana, and used the bear to rebuild core infrastructure, expand permissionless features, and ship constant-liquidity pools

Late 2023 to 2024: Asset issuance surged, and the pool-fee pivot transformed a load problem into a revenue generator. Onchain volumes exploded upwards which also drove Raydium’s baseline revenue on trading fees, leading to exponential growth in $RAY buybacks.

2025: Focus on smoothing revenue deployment and improving market impact of buybacks, including ideas like time-weighted buyback schedules and providing bid-side liquidity with earned fees.

Balancing Incentives with Profitability

Emissions are now limited and Raydium remains net deflationary by a wide margin. Incentives are used selectively to solve cold start problems for new products such as the Launch Lab bonding curve program. Rewards target trader volume and creators, not just LPs. The bar is clear: incentives must show a credible path to fees and repeatable revenue, or they are wound down.

Raydium’s Future

Raydium wants to be the destination for forward-looking projects, not just a liquidity provider but a partner for successful launches of all asset classes. Raydium’s growth will be synonymous with Solana. The goal is simple and ambitious: be the first place to list, swap, and discover assets on Solana mainnet, not on a side network. The competitive landscape is intense, so the plan is relentless improvement of the core swap experience, product breadth, and revenue durability.

As 0xInfra puts it:

“The real moat is the relationship with the end user, the trader. That is what we are building for in 2025.”

Episode Timeline

00:00 Introduction to Raydium and 0xINFRA

02:38 Understanding Raydium's Business Model and Revenue Streams

05:30 Growth Journey: From Zero to First Million

08:42 Revenue Generation Strategies and Innovations

11:15 User Experience and Market Positioning

13:51 Balancing Growth and Profitability

16:18 Navigating Market Cycles and Resilience

19:11 Future Vision for Raydium and Solana

Looking for more insights from top growth experts? Sign up for the Safary Certification—a hands‑on crypto marketing course taught by the growth minds behind Berachain, EigenLayer, Kraken, and more (spots are limited).