Welcome to Episode 4 of Safary’s Revenue Series! 🦁

We’re interview the growth operators behind the companies that are *actually* making money in crypto. We’ll break down their growth strategies, challenges, and tech stacks to give you the insights you need to grow your business in crypto & beyond.

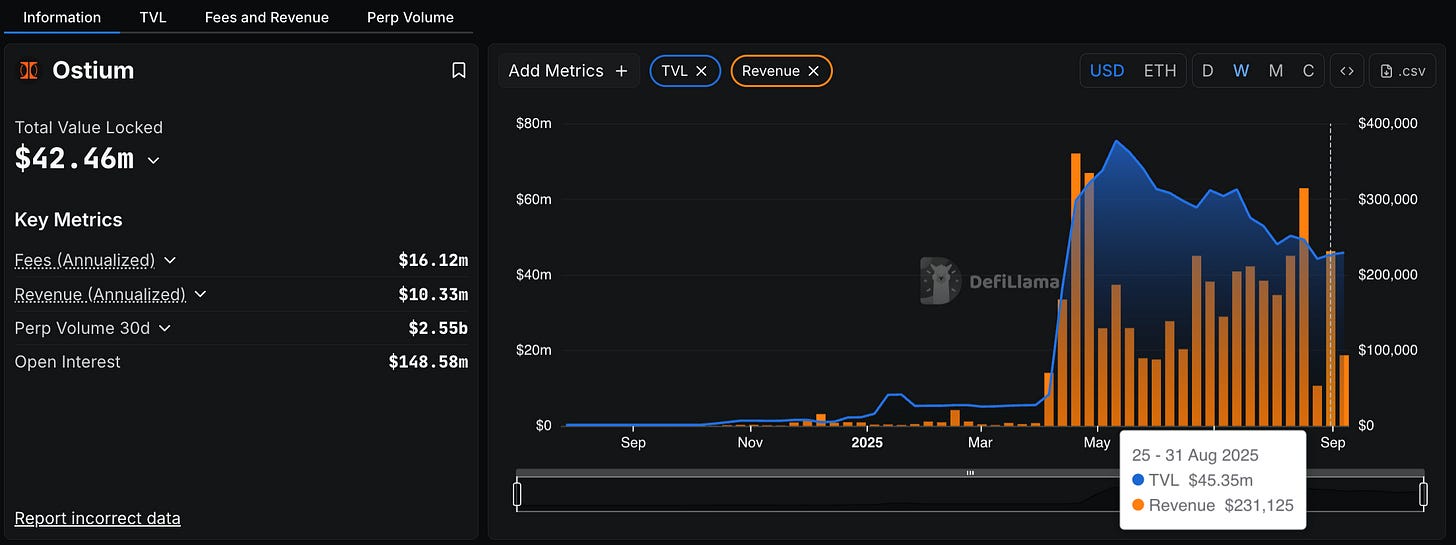

In this episode, Justin sits down with Chris (“Flow”), Head of BD at Ostium, a DeFi protocol creating the RWA (real-world assets) liquidity layer for both institutions and onchain traders.

Flow began in tradfi and eventually made his way to crypto during the 2020 volatility boom. What started as personal trading evolved into full-time work in DeFi, where he built a name for himself across Crypto Twitter and transitioned into growth and BD.

At Ostium, the mission is clear: to become the most liquid onchain venue for trading RWAs like equities, gold, oil, and indices. By serving both institutions and retail degens, Ostium bridges traditional markets with crypto native trading infrastructure.

How Ostium Makes Money

Ostium generates revenue through trading fees, but unlike most DEXs that charge both opening and closing fees, Ostium charges only on entry. Liquidations and volatility spikes also contribute significantly to protocol revenue. Over time, the goal is to push costs closer to zero (mirroring Robinhood’s innovation) while maintaining sustainable revenue through institutional partnerships.

The Road to First $1M in Revenue

Instead of competing directly with other perpetual DEXs by listing the same altcoins, Ostium differentiated itself by offering unique RWA assets (S&P 500, Nasdaq, commodities) at moments of macro volatility. This timing, paired with their focus on sales-driven growth, led to their first million in revenue.

Key tactics included:

Outbound Sales: Manually building lists of 1,000+ active traders on Twitter, doing cold outreach, setting up one-on-one calls, and white-glove onboarding.

Whale Focus: Prioritizing large traders who drive 80% of volume, then cultivating relationships to grow their activity.

Branded Launches & Contests: Consistent, recognizable asset launches and trading competitions created both trust and ROI-positive volume spikes.

Lessons on Growth

Flow contrasts crypto’s marketing-first culture (narratives, hype, broad messaging) with Ostium’s hybrid marketing + sales-led approach, which he argues is critical for any revenue-generating DeFi business.

Some takeaways:

Double down on what works; don’t get distracted by every new marketing trend

Be willing to spend on contests/incentives when ROI is clear

Track real activity metrics (volume-to-OI ratios, capital efficiency) instead of vanity numbers

Focus on revenue as a core KPI, not just TVL or social metrics

Watch the full episode for all of Flow’s growth insights!

Episode Timeline

00:00 Introduction to Ostium and Flow's Background

03:11 Understanding Ostium's Business Model and Revenue Streams

06:42 Growth Strategies: From Zero to First Million

10:49 Sales-Led vs. Marketing-Led Approaches in Crypto

14:53 Unlocking Revenue: Insights and Strategies

17:56 Trading Contests and User Engagement Strategies

20:09 Ongoing Growth Methodologies and Metrics

22:24 Navigating Market Volatility and Revenue Strategies

27:03 Advice for DeFi Founders on Revenue Generation

31:36 Future Business Models and Success Metrics for Ostium

Looking for more insights from top growth experts? Sign up for the Safary Certification—a hands‑on crypto marketing course taught by the growth minds behind Berachain, EigenLayer, Kraken, and more (spots are limited).