Welcome to Episode 5 of Safary’s Revenue Series! 🦁

We interview the operators behind the companies that are actually making money in crypto. We break down their growth strategies, challenges, and tech stacks so you can grow your business in crypto and beyond.

In this episode, Justin sits down with Rooter, the founder operator behind a suite of DeFi products on Sui: Suilend (lending and borrowing), SpringSui (liquid staking) and Steam (AMM and token launch venue).

What They Do & Who It Serves

Suilend (lending): borrow and lend crypto assets. This is the flagship product and primary revenue driver

SpringSui (LST): Sui’s leading liquid staking token with instant liquidity and the ability to use staked SUI across DeFi

Steam (AMM): a DEX integrated with the suite for token launches, LP, and trading

The pieces reinforce each other: idle AMM liquidity is lent out for extra yield, LST utility flows into lending, and users move seamlessly across products.

How Suilend Makes Money

Most DeFi protocols boast big TVL numbers but struggle to capture real revenue.

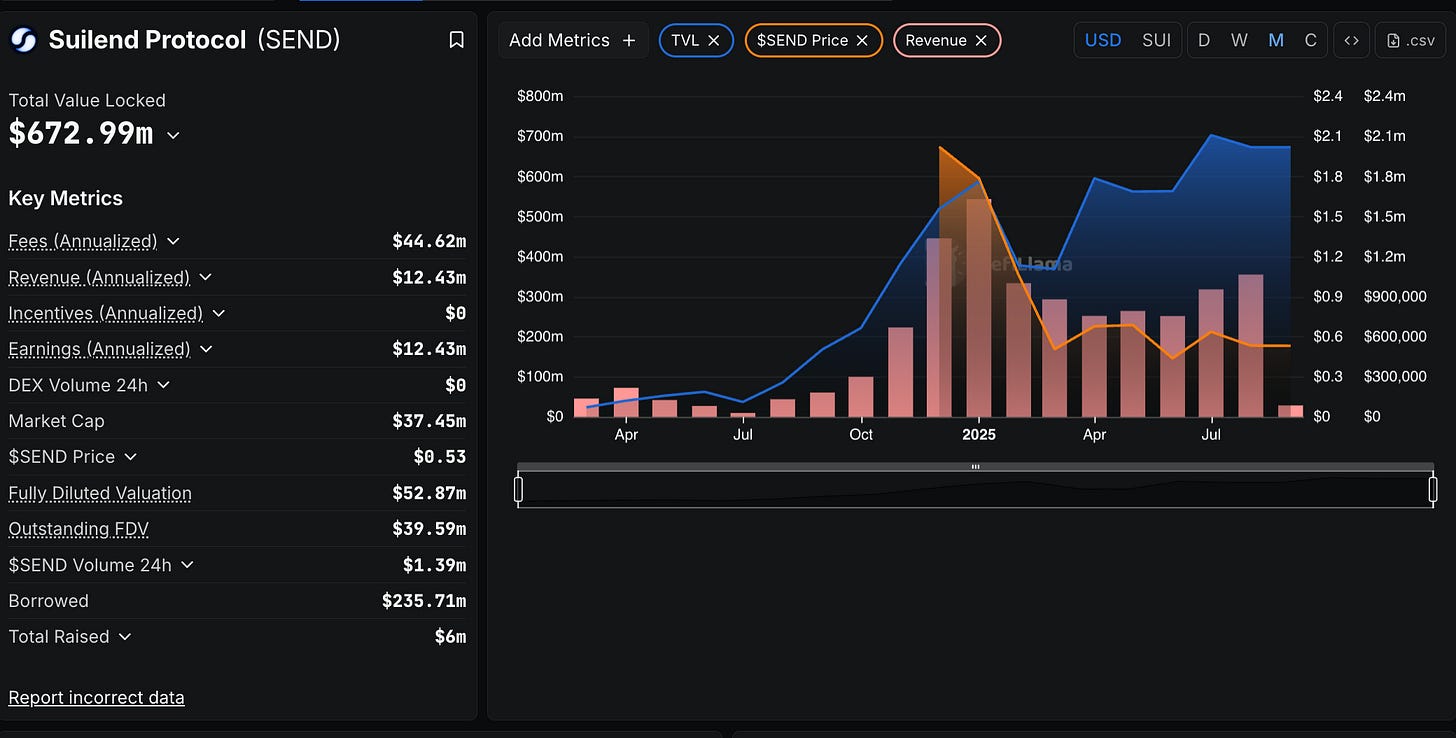

Suilend is different. Built as Sui’s leading DeFi suite, they’re now generating $10M+ per year.

Break down by product:

Suilend (lending): spread fees on borrowing, roughly 20 percent of interest to the protocol. Current run-rate about $10M annualized. Origination fees were reduced to 0 percent to remove friction.

SpringSui (LST): no protocol fee by design. It functions as public-good infrastructure that grows utility and TVL for the suite

Steam (AMM): standard DEX trading fees with 20 percent of fees to the protocol. $0.5 to $1M annualized

“Charge fees when you can. In crypto, bull markets are when revenue is made, and bear markets will inevitably slash it 90 percent. Do not wait to monetize.”

Growth Journey: From Launch to $10M+

Led with lending. Prior experience running Solend on Solana supplied credibility, distribution, and product edge.

Airdrop meta tailwinds. Users tried high-quality apps without tokens yet, which boosted early adoption.

Quality and yield. Early yields were market-leading, and instant unstaking differentiated the experience.

The Sui bet. A calculated choice based on Move, a senior core team, and strong L1 performance.

“It was not dumb luck. We believed Sui’s developer-first approach would bring more projects, tokens, and users. That thesis played out.”

What Drove 10x Growth

Ecosystem tailwinds: As Sui’s TVL and token price expanded, usage across the suite accelerated

Convenience as retention: Aggregators, one-click swap-and-deposit, and programmable transaction blocks keep users parked in SwiLend even when headline yields cool

Founder-led marketing: Rooter’s 25k+ following on Twitter supplies a steady distribution engine.

Curated community incentives: Capsule NFTs reward high-quality UGC with redeemable tokens, creating delight without inviting farmable spam

Thoughts on Token Price vs Fundamentals

Short-term token performance has not always tracked to improving business metrics. The team is comfortable staying the course and using treasury-funded buybacks to align incentives.

“As long as we keep building valuable products that generate real revenue, the fundamentals will take care of the rest.”

Lessons for DeFi Builders

Pick the right chain. Ecosystem momentum matters as much as product

Charge early and credibly. Set sustainable fees during expansion to fund durability during contraction

Use hype as a funnel and product as the engine. High yields and airdrops attract, convenience and integrations retain

Let the stack compound. Reuse liquidity across components so every product strengthens the others

Favor curated rewards over farmable faucets. Human-reviewed incentives keep quality high and spam low

Looking for more insights from top growth experts? Sign up for the Safary Certification—a hands‑on crypto marketing course taught by the growth minds behind Berachain, EigenLayer, Kraken, and more (spots are limited).